ISLAMABAD (Kashmir English): The National Savings Centre (Qaumi Bachat Bank) continues to offer a convincing monthly profit on Behbood Savings Certificates, one of the country’s most popular investment options for widows, senior citizens, and persons with disabilities.

The profit rates, last revised in July 2025, remain unchanged in October, providing a stable return for small and medium investors.

Launched in 2003 to support widows and elderly citizens only, the scheme was later extended in 2004 to include persons with disabilities and special minors through their guardians.

The scheme is widely regarded as one of the most secure and rewarding investment avenues for fixed-income individuals.

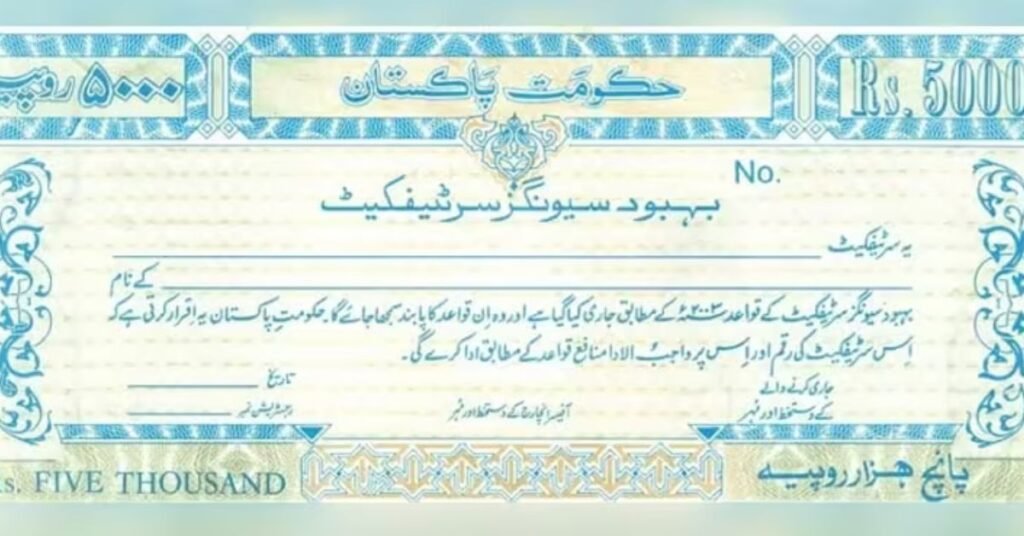

The certificates are available in denominations of Rs5,000, Rs10,000, Rs50,000, Rs100,000, Rs500,000, and Rs1,000,000.

Behbood Savings Certificates monthly earning

The authorities have set a profit rate of 12.96% per annum for Behbood Savings Certificates. This translates to a monthly profit of Rs1,080 on every Rs100,000 invested.

With consistent payouts and government-backed security, the Certificates remain a preferred choice for Pakistanis seeking uninterrupted, risk-free income amid economic uncertainty.

Investment Limit

Maximum investment for a single person is Rs7.5 million

Maximum investment for joint investors is Rs15 million

Eligibility Criteria

According to the official National Savings website, the following individuals can purchase Behbood Savings Certificates:

Senior citizens aged 60 years or above

Widows (as long as they remain unmarried)

Joint investors falling under the above two categories

Disabled persons holding a CNIC with a disability logo, and special minors through their guardians